Text by Jiang LU (Maxime LU)

Tag Archives: china

Wine Market and Education Promotion in China

Wine Market and Education Promotion in China

– LU Jiang (Maxime) / WineOnline.CN –

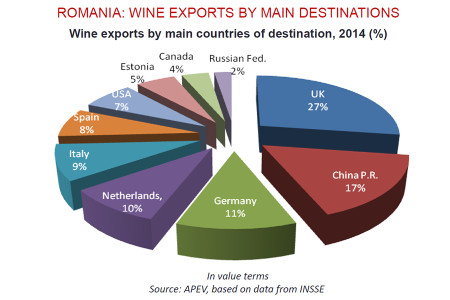

Due to the great potential and rapid growth of China’s wine market, the past decade has witnessed the attention and participation from most wine producing countries worldwide. Much investment has flown into the market. However, in 2012 the Chinese government has adopted the policy of restricting three public consumptions (oversea trips, vehicles and banquets). Furthermore, sluggish economic growth and rash investment in the sector has made conducting business in China’s wine market a bleaker landscape more challenging. Wine imports have decreased by 4.46% (YOY) in 2013 and by 12.8% (YOY) in the first half of 2014.

Official and corporate consumption used to be the bulk of Chinese wine sales. Corporate purchases, gift-giving and dinners occupied the lion’s share of the market. By restricting three public consumptions combined with a stagnating economy, the relevant market share shrank dramatically. Individual consumption has become the focus of the market. The market changed unexpectedly and eventually experienced a hard landing. During the change, many dealers suffered greatly as they relied heavily on corporate or official consumption. Sales dropped remarkably and some dealers even retreated from the Chinese market. Nevertheless, the outlook for the industry is mixed. In short term, the drastic changes will unsettle dealers, but in the long run the industry’s hard landing and the value return will contribute to a healthy contraction and eventually higher quality standards of the Chinese wine industry.

As for individual consumption and the market orientation for value return, some witty entrepreneurs have acted swiftly. Over the past year, they have flexibly readjusted the pricing and sales strategies to cater for personal consumption. On the other hand, they have improved marketing strategies and taken measures to explore the market against the bleak backdrop. They, in particular, have devoted much effort in education campaigns by cultivating regular customers and newcomers, creating demand and exploring new fields of consumption. Leading wine import businesses like ASC, Aussina World Wines, yesmywine.com and Vats Liquor have put much effort into capacity building in their education teams or marketing departments. They have initiatively cooperated with others to conduct standard systematic courses, different courses on wine regions and various master courses. Their efforts pay off in the promotion of enterprises and brands and customer development.

Although the wine market’s outlook seems to be grim in terms of imports and exports as a whole, the market is becoming more rational. The stockpile out of indiscriminate purchase is being consumed this year, as we can see from a lot of leftover stock or bargains. Actually, personal consumption has increased obviously, which can be seen by soaring e-commerce sales. On the other hand, the burgeoning growth of the wine education market manifests this trend. Master courses and courses on wine regions are on the rise. There are participants of wine systematic courses. Take WSET course from Britain as an example. After the past decade’s growth, especially for the last 2-3 years, their student numbers have increased rapidly. Nowadays, China is one of the largest providers for WSET students. Due to the strong demand, sites of lecturing are on the rise.

Meanwhile, oversea wine producers are trying to break bottleneck in an effort to pursue larger market shares in China. Among their efforts, official courses on winegrowing regions and master courses lectured by international wine masters are effective in practice. France and Australia, top sellers in the Chinese market, are two leading promoters for courses on wine regions.

France found its way into China in the late 1990s. As a pioneer of introducing courses

China’s wine market is currently in a turmoil. Nevertheless, there are signs of great potential and burgeoning growth. One of the major driving forces is wine education for consumers and industry players. Wine education will make the market more rational and healthier and will also offer more business opportunities.

澳洲之旅的相关报道-Joint initiative bears fruit

上月下旬,包括我在内的6家媒体(博客)走访了南澳、西澳,历时10天,因为正在为几本杂志写澳洲葡萄酒之旅的稿件,所以还未发博客。

不过澳洲葡萄酒管理局(Wine Australia)和澳洲旅游局已经有新闻发出。附一下,做个记录。

—————————————————————————

Joint initiative bears fruit

Chinese Opinion Leaders Experience Some of Australia’s Best Drops .

http://www.wineaustralia.com/en/News%20and%20Events/News/Joint%20initiative%20bears%20fruit.aspx

Six of China’s leading wine and lifestyle opinion leaders have been visiting Australia this month as part of a joint Tourism Australia and Wine Australia initiative to promote Australia’s world class tourism and wine experiences to potential Chinese visitors.

The visiting opinion leaders represent major media titles and wine blog sites in China such as WineOnline, WineBlogChina.com, Vinehoo.com, Wines Info, U Life Magazine, Men’s Uno and the Robb Report, which have a combined following of more than one million Chinese.

Their Australian itinerary has included visits to more than 10 wineries and talks with leading winemakers in the McLaren Vale, Adelaide Hills, Barossa and Margaret River.

Tourism Australia Managing Director Andrew McEvoy said the visiting opinion leaders would help to extend the global message of why There’s nothing like Australia in one of Australia’s most important tourism markets.

“China continues to be a market of increasing significance for Australian tourism and is now our single most important market in terms of value – worth $3.8 billion annually – and key to our long term plans for growth,” Mr McEvoy said.

“Whilst we know that Australia’s nature is incredibly appealing to Chinese travellers, and has helped to drive the demand for our tourism experiences, we want to extend their knowledge that our landscape has also created some of the world’s finest wines. “Hosting these influential opinion leaders will help to spread word-of-mouth advocacy in China about the many and compelling reasons why Australia is a world class tourism destination, especially those experiences that are built around our wine and food offering,” Mr McEvoy said.

Mr McEvoy added the visit followed recent research commissioned by Tourism Australia that shows while Australia’s world class beauty and natural environment are the primary reason why Chinese travellers choose to visit, the country’s wine and food offerings enhance their reasons to visit and the experience when they are here. Wine Australia Chief Executive Andrew Cheesman said the visit would help showcase the quality and diversity of Australian wines and wine regions. “China is Australia’s fastest growing export market for Australian wine, with bottled wine exports to China delivering double digit growth in both value and volume this year,” Mr Cheesman said.

“Australian wines are fast gaining a reputation in China for their high quality, and the diversity of styles means they are very well matched with Chinese cuisines. “Education and engagement of consumers, sommeliers, wine educators, importers, media and other key influencers is central to Wine Australia’s strategy in China and this visit by some of China’s media opinion leaders is a major part of that.”

South Australian wineries involved in the visit have included: Hardy’s Tintara, Angove McLaren Vale, d’Arenberg Vineyard &Winery, Chapel Hill Winery, Petaluma’s Piccadilly Vineyard, Shaw & Smith, The Lane Vineyard, Grant Burge Wines, Jacob’s Creek, and Peter Lehmann Wines.

In Western Australia wineries visited included Fraser Gallop Estate, Stella Bella, Brookland Valley Winery, and Cullen Wines.

Tourism experiences featured on the program in South Australia have included: Cheese and Olive Oil tasting with the producers of McLaren Vale , Cleland Wildlife Park, Star of Greece Café’, Hilton Adelaide and Hilton Brasserie, The Victory Hotel, Barossa Trike Tours, Novotel Barossa Resort and Harry’s Restaurant in South Australia.

Western Australian tourism experiences have included: Pullman Resort Bunker Bay, Margaret River Gourmet Escape, Naturaliste Charters Whale and Dolphin Eco-Tours, Swan Jet Adventures, The Bell Towers, The Trustee Bar & Bistro, Busselton Jetty & Underwater Observatory, Esplanade Hotel Fremantle, Little Creatures Brewery, The Round House, Didgeridoo Breath, Cottesloe Beach, Crown Perth, Kings Park, Wandering West Tours, Perth Mint, and Must Wine Bar.

In the past year Australia welcomed 606,400 visitors from China (September 2012 year end), making it the second largest source market for visitors after New Zealand. As part of Australia’s Tourism 2020 strategy, China is expected to grow to as much as $9 billion and 860,000 visitors annually by the end of the decade.

China is Australia’s third largest market for Australian bottled wine exports and the biggest for bottled wine exports above A$7.50 per litre, ahead of the US and Canada. China’s demand for premium wine continues to drive strong growth in the higher priced Australian wine segments, with the above A$10.00 per litre segment a stand‐out, up 37 per cent. The average value per litre of Australian bottled imports to China is now for the first time higher than the average for French wines.

西萃葡萄酒(SSQW)品酒会品鉴记录

西萃葡萄酒(SSQW)品酒会品鉴记录

SSQW Spanish Wines Tasting

陆江(Maxime LU)/万欧兰葡萄酒俱乐部

应邀参加了西萃葡萄酒国际(SSQW-Sino Spain Quality Wines,S.L)在北京柏悦酒店举办Master Class品酒会。BMA酒庄酒庄主兼SSQW总经理Jaime Postigo Gomez主持本次品酒会。看到不少熟识的北京葡萄酒相关的媒体和从业者朋友,也参加了本次品酒会。

首先Jaime介绍了西萃葡萄酒国际(SSQW)本次提供品鉴的西班牙葡萄酒酒庄的历史与庄主家族相关故事。同时也提到酒庄在慈善事业的贡献。

这次品鉴用酒,是四款欧洲米其林二、三星酒单入选的中高端西班牙葡萄酒,都是经过西萃葡萄酒国际(SSQW)精心挑选出的,并首次带入中国市场。

详细酒评如下:

1. 托马斯特酿—干白2009,TOMAS POSTIGO Blanco 2009,(D.O.Rueda)

淡黄金微绿,柚子,香草,奶油,烤坚果,黄桃气息;中重酒体,酸度强,贯穿持久,口中桶味和果味并现,平衡,凝缩,回味长。过了6-7个月的橡木桶,产量1.1万~1.3万瓶.

2. 仙女园,VINA COQUETA 2006,(D.O.La Rioja)

深红泛紫,黑莓,雪茄盒,黑巧克力,甘草,烟熏,后续湿羊毛;重酒体,凝缩,单宁强,细腻,细致,有结构感,口中有烘烤,烟熏,黑色水果味道,酸度强,平衡;回味长,烟熏。

3. 托马斯特酿-干红2009,TOMAS POSTIGO Tinto 2009,(D.O.Ribera del Duero)

不透光深紫红色,黑莓,蓝莓,一丝湿羊毛,肉桂,clove, 重酒体,强劲单宁,口中有李子等黑色水果气息,收敛极有力,酸度中强,雄壮,活跃清新,平衡;回味长,有李子干,无花果干和烟熏味道。

4. 马达加斯诺森林,(BMA) 2009 Bosque de Matasnos BMA Tinto 2009,(D.O.Ribera del Duero)

鲜艳紫红色,湿羊毛,湿灌木,蓝莓,黑醋栗,烟熏;重酒体,微甘,单宁细腻中强,无花果干, 烟熏,黑醋栗,酸度强劲,细致,平衡;回味长,黑醋栗, 甘草。