By Maxime Lu / 陆江 ( 21 April 2016)

Published on DecanterChina.COM, Chinese version of Decanter.

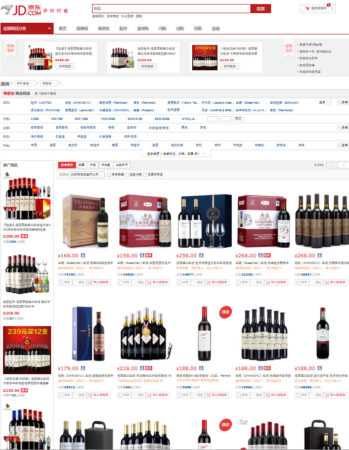

JD.com, one of China’s biggest online retailers, spoke to DecanterChina.com about how they choose producers for their fast-growing wine sector and the efforts made in preventing fake wines.

·Click here to read Part I of the interview on the scale and current state of JD.com’s growing wine business.

Direct import: choosing reputable suppliers

Among wines directly sold by JD.com, there are two types, said ZHAO Dabin, head of the wine department of JD.com. One type is wines bought directly by JD.com from overseas producers or their Chinese agent. ‘We always choose reputable suppliers in the business,’ said Zhao.

The other type is the big and famous wine brands owned by major companies and groups. ‘They have their own quality control system, so fake wines won’t be an issue.

’When working with agents, ‘we usually involve the producers as well to guarantee the authenticity of these products’, he said.

‘For any wine we choose, we’ll conduct internal tastings. This can, to some extend, assess the quality of these wines’, said Zhao Dabin.

‘Our reputation has always relied on importing authentic and reputable goods.’

Merchants: play by the rules

Unlike direct import brands, the online retailer has ‘relatively less control’ over registered merchants, said Zhao.

Instead, merchants need to sign ‘rigorous agreements’ with JD.com when they seek to start up a shop with the retailer. They also need to pay a deposit to the retailer as a guarantee of the quality.

Should any registered merchant sell fake wines, they need to pay ‘a minimum fine of 1m RMB or 10 times of the total sales of these fake wines, whichever is highest’.

To supervise the merchants, JD.com has a ‘dedicated quality-control department’, who would regularly examine random samples from the portfolios sold by merchants.

‘We also have a third-party institution who regularly visits our warehouses, as these warehouses temporarily store some merchants’ wines before shipment. They are responsible for sampling and examining the quality of these wines.’

A ‘consumer experience department’ was set up with the involvement of LIU Qiangdong, Managing Director of JD.com, who has a ‘personal interest in wine’, according to Zhao.

The department regularly purchases wines from JD.com, in order to test the quality of the wines like a consumer.

Choosing the right producers

In terms of choosing direct import brands, ‘we try to cover the most famous wine regions in the world, namely the top three or five producers of each region,’ said Zhao, adding that these wines need to be ‘value-for-money’.

JD.com also buys wines from domestic distributors with ‘less rigorous criteria’ than direct import, ‘but we would choose carefully’.

‘Because we have an enormous sales volume, we need the local distributors to give us a very competitive price,’ said Zhao.

When seeking for a producer in a certain region, ‘we would firstly try our connections in the wine circle, or ask local trade bodies to recommend producers for us,’ said Zhao. The online retailer also sends their buyers to trade fairs including Vinexpo and ProWein to choose wines at the scene.

For producers who directly get in touch with JD.com, the retailer would ask for samples to do a blind tasting first. ‘We may choose a few; then we will discuss with the producers about prices and how we can work together.’

Image: ZHAO Dabin (right on the front) and LIU Qiangdong of JD.com signing agreement with Treasury Wine Estates·

Storage and logistics

How to store and deliver the wines has been one of the most difficult tasks for start-up online wine shops in China. Upon receiving investments, many online retailers have reported spending them on developing a storage and logistics system.

Delivery is not a major problem for a big-scale and mature online retailers such as JD.com, said Zhao Dabin.

Besides having their own express delivery network, ‘we package our wines in the same way as delicate electronic products such as mobile phones.’

As for storage, JD.com currently uses their food storage warehouse, some under normal temperature, some with constant temperature and humidity, to store their more affordable wines. ‘These are not professional wine cellars,’ admitted Zhao, ‘Considering we mainly store fast-selling wines in these warehouses, and it takes only a month for the wines to enter and leave the warehouse, the influence should be minimal.’

Fine wines, certainly, enjoy more professional storage environment, said the retailer.

Wine shopping tips on JD.com

Ask JD.com: I always find various sales deals and discounts vouchers for wines on JD.com. But why are these wines discounted?

Zhao Dabin: In most occasions these wines are slow sellers from our merchants, which is why they need to be pushed with discounts.

Also as we buy wines in big volume, we usually get very competitive prices, hence the discount.As for the vouchers, they are usually paid for by JD.com, with some help from our partners as well. Therefore, it’s very possible for people to find wines sold under the average market price on JD.com.

Translated by Sylvia Wu / 吴嘉溦

All rights reserved by Time Inc. (UK) Ltd.